Supplier News

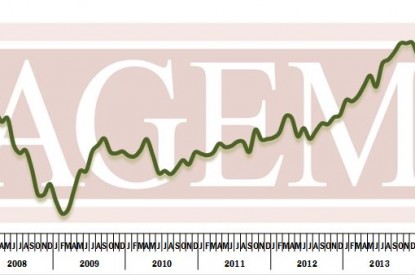

US – AGEM Index down in December

By Phil - 9 January 2015

In the final month of 2014, the AGEM Index reported a composite value of 181.84, representing a decline of 3.74 points when compared to November 2014.

Compared to a year ago, the AGEM Index declined 12.11 points The index reported monthly declines for four consecutive months and was down for nine of the past 12 months. In December, Global Cash Access (GCA) completed its acquisition of Multimedia Games Corporation, removing Multimedia Games from the overall index.

During the latest period, eight of the 14 global gaming equipment suppliers reported month-to-month gains in stock price, with one reporting a gain of more than five percent. Of the six companies reporting a month-to-month decline in stock price, two were down by more than five percent.

The broader stock markets also reported a downturn in December 2014 when compared to the prior month. The Dow Jones Industrial Average declined modestly, falling from 17,828.24 to 17,823.07. The S&P 500 ended the month at 2,058.90, representing a decline of 0.4 percent, while NASDAQ witnessed a 1.2-percent decline to 4,736.05.

International Game Technology (IGT) reported a stock price of $17.25, up 1.3 per cent and contributed 0.50 points.

Daktronics (DAKT) contributed 0.24 points due to a 4.9 per cent gain in stock price to $12.51.

The biggest stock price gainer, Ainsworth Game Technology (AGI), jumped 5.4 per cent. Due to exchange rate fluctuations, the supplier contributed 0.04 points to the overall index.

Scientific Games Corporation (SGMS) reported a stock price of $12.73, down 15.9 per cent and contributed negative 1.54 points.

Aristocrat Technologies (ALL) reported a 0.8 per cent increase in stock price to AU$6.56. However, due to a decline in exchange rate, the company contributed negative 1.10 points to the index.

Gaming expansion continues in the state of New York. In November 2013, voters in the Empire State approved a constitutional amendment to expand casino gambling. As a result, New York State, which has nine racetracks with video-lottery terminals and five tribal casinos, will eventually add up to seven commercial casinos. However, initially, only four casinos will be allowed, and all of them will be located in upstate New York.

The New York State Gaming Facility Location Board recently awarded licenses to three operators, including Montreign Resort and Casino, Rivers Casino and Resort and Lago Resort Casino. Another 13 proposals were rejected by the review board, including plans from Caesars Entertainment to build an $880m casino in Orange County and Genting’s proposal for a $1.5bn development in Sterling Forest.

Montreign Resort and Casino will be located in Thompson in the Catskills. The $1.1bn project will include an 18-story resort with 391 hotel rooms and an 86,300-square-foot casino with 61 table games and 2,150 slot machines. The property is also expected to include an 80,000-square-foot indoor water park, a golf course and a 200,000-square-foot entertainment village.

Rivers Casino and Resort will be built in Schenectady County. The project will cost an estimated $300 million and will include a 150-room hotel and a 50,000-square-foot gaming floor. The casino will include 66 table games as well as 1,150 slot machines.

Lago Resort and Casino will be located in Seneca County. The $425m project will include a 94,000-square-foot casino with 2,000 slot machines and 85 table games. In addition, the development will include 207 hotel rooms, a 40,000-square-foot pool area and a 10,000-square-foot spa.

In addition to the three commercial casinos soon to be underway, the Oneida Indian Nation is planning to open a $20m casino in Chittenango, which is 60 miles from the planned Lago Resort and Casino in Seneca County. The 67,000-square-foot development is expected to open in the spring of 2015 and will include 430 slot machines, a 500-seat bingo hall, dining, a country western bar and a general store.

As casino gambling in the state of New York continues to expand, global gaming equipment suppliers are keeping a close eye on opportunities in the region. However, concerns regarding the supply-demand balance in the region persist.