Interactive

South Africa – CASA pitches missed online tax revenues at R2.2bn

By Phil - 14 January 2015

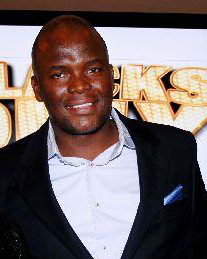

Themba Ngobese, Chief Executive Officer of The Casino Association of South Africa has asked national legislators to consider introducing legal online gaming saying illegal online gambling is on the rise and that the government is missing out on crucial tax revenue.

He pitched the tax that the government was missing out on as being over R2.2bn.

“We have seen a mushrooming of online gaming operations which are disguised as internet cafés and/or entertainment lounges,” Mr. Ngobese explained on Moneyweb Radio. “They are mushrooming all over the country and what they really offer is illegal online gambling. We always make an estimate and say, look, our gaming tax, which excludes VAT and corporate tax as of the end of the year at March 2014, was just about R2.2bn (US190m). If they do five per cent of what we do, then the country and coffers are losing R110m in terms of gaming tax, which is a big figure.”

“We believe that it (regulation) is the future; unfortunately it is illegal as outlawed by statute, but it’s happening nonetheless and unfortunately also competing with us, which is not fair under the circumstances in which we operate,” Ngobese added. “What we are saying is please just stay away from online gambling because of the negatives associated with it in terms of tax. As things stand today, we do not have even a bill that has been presented in parliament for consideration – that’s the situation that we stand with. We are aware of a bill that is due to be presented at some stage by the opposition party in the National Assembly, but that has not yet happened, unfortunately. Until it is legislated, stay away from it; and, of course, if it’s legalised, then it’s a fair playing field and everyone should be able to participate in it.”