Supplier News

US – AGEM Index down in August

By Phil - 14 September 2016

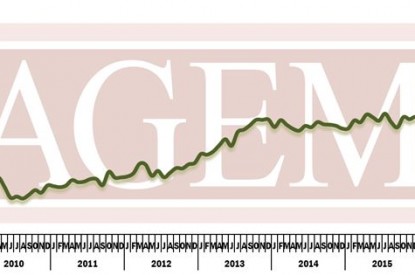

The AGEM Index posted a slight decrease in August 2016 after gaining 34.67 points in July 2016.

The composite index stood at 286.40 at the close of the month, which represents a decrease of 8.29 points, or 2.8 per cent, when compared to July 2016. The AGEM Index reported a year-over-year increase for the 11th consecutive month, rising 95.95 points, or 50.4 per cent, when compared to July 2015.

During the latest period, half of the 14 global gaming equipment manufacturers reported month-to-month increases in stock price, with three up by more than 10 per cent. The balance of manufacturers reported decreases in stock price during the month, with one declining by more than 10 percent.

The broader stock markets reported mixed results in August 2016. The S&P 500 reported a month-to-month decrease of 0.1 percent, falling to 2,170.95. Additionally, the Dow Jones Industrial Average decreased 0.2 percent to 18,400.88, and the NASDAQ increased 1.0 per cent during the period to 5,213.22.

International Game Technology (IGT) contributed 5.41 points due to a 9.2 per cent increase in stock price to $22.83.

Daktronics (DAKT) reported a stock price of $9.53 (+47.3 per cent) and contributed 2.53 points.

With a stock price of $64.32 (+3.2 per cent), Crane Co. (CR) contributed 1.55 points to the overall index.

With a stock price of $15.10 (-5.3 per cent), Aristocrat Technologies (ALL) contributed negative 9.68 points.

Konami Group (TYO: 9766) contributed negative 6.21 points due to an 8.4 per cent decline in stock price to ¥3,665.

Scientific Games (SGMS) reported a stock price of $8.25 (-22.6 percent) and contributed negative 2.08 points.

A number of industry manufacturers released their quarterly financial results in recent months. Selected company highlights below suggest mostly positive results for key players in the industry.

Everi (EVRI) reported a 3.7 per cent increase in revenues for the second quarter of 2016. Revenue was up $7.6 million to $214.0 million in the quarter. Growth for the quarter was fueled by the payments portion of Everi’s business, which features cash access solutions to gaming establishments such as ATM cash withdrawals, credit card cash access transactions and debit card transactions. The payments business comprised 75 per cent of Everi’s business this quarter, growing revenues by 5.4 per cent from the prior year. Everi’s gaming business declined by a modest 1.1 percent on the year as the company reported its the installed base remained relatively flat from 2015 as new casino openings have slowed.

Galaxy Gaming (GLXZ) reported a 14 per cent increase in revenue for the second quarter of 2016, reaching nearly $3.1m. The independent developer, manufacturer and distributor of casino table games and systems posted a 15 per cent gain in revenue during the first half of 2016. Premium games displayed the largest revenue growth, while every product category showed positive year-on-year gains. Premium games are of critical importance to Galaxy’s revenue growth as they command a higher price point relative to Galaxy’s other products. The United Kingdom also helped drive revenue growth as Galaxy saw increasing utilization of their products in the region. Earnings growth (adjusted EBITDA) was an impressive 56 percent on the year, largely a result of the revenue gain and lower selling, general and administrative expenses.

Gaming Partners International (GPIC) reported $20.3m in revenue for the second quarter of 2016; revenue was up $4.1m, or 25.3 per cent, over the same quarter in 2015. GPIC attributed the growth in revenue primarily to increased sales of casino currency in the United States and RFID solutions in Asia.

Intralot reported a 13.3 per cent increase in revenue to €331.9m for the second quarter of 2016. Intralot’s revenue increase was primarily driven by growth in the United States, Turkey and Bulgaria. Intralot made several strategic acquisitions in the second quarter of 2016. Intralot completed its acquisition of Gamenet to expand its reach in the Italian gaming market. Intralot then sold 80 percent of its stake in Intralot de Peru to the Peruvian Nexus Group. Intralot also completed the acquisition of a stake in Eurobet, a leading Bulgarian gaming company. Most recently, Intralot announced discussions with Tatts for a potential sale of Intralot’s Australian and New Zealand businesses.