Operator News

US – Shareholders approve Eldorado’s deal with Caesars but more casinos could be shed

By Phil - 18 November 2019

Shareholders at Eldorado Resorts and Caesars Entertainment have approved certain actions in connection with Eldorado’s acquisition of Caesars at separate Special Meetings of Stockholders.

The transaction is expected to be consummated in the first half of 2020 and remains subject to the receipt of all required regulatory approvals, and other closing conditions.

Holders of over 99% of the Eldorado shares that voted on the issuance of shares of Eldorado common stock in connection with transactions contemplated by the merger agreement with Caesars cast their votes in favour, representing approximately 87% of Eldorado’s outstanding common stock as of the record date for the Eldorado stockholder meeting.

Holders of over 99 per cent of the Caesars shares that voted on the merger cast their votes in favour, representing approximately 76 per cent of Caesars’ common stock outstanding and entitled to vote as of the record date for the Caesars stockholder meeting. Eldorado and Caesars stockholders also approved each of the other matters on their respective meeting agendas, including the Eldorado stockholders’ approval of the reincorporation of Eldorado from Nevada to Delaware subject to and promptly following the consummation of the merger.

Stockholders also approved the new 11-person board of directors for the merged company. Eldorado is providing six of its current board members to the combined company: Chairman Gary Carano, CEO Thomas Reeg, who will be CEO of the combined company, David Tomick, Frank Fahrenkopf Jr., Michael Pegram and Bonnie Biumi. Current Caesars directors Keith Cozza, Jan Jones Blackhurst, Don Kornstein, Courtney Mather and James Nelson will be part of the new board. Cozza, Mather and Nelson were appointed to the Caesars board earlier this year by corporate raider Carl Icahn, who controls more than 28 percent of the company.

Both companies have agreed to reduce the number of casinos operated in markets where federal anti-trust issues could exist, whilst also reducing overall corporate costs by $500m. Three Caesars casinos under the Harrah’s brand in Atlantic City, Laughlin, Nevada and New Orleans were sold to real estate investment trust VICI Properties for a combined $1.8bn. VICI will lease the operations back to Eldorado for total annual rent of $154m.

Eldorado meanwhile has sold three casinos, two in Missouri and one in Mississippi, to VICI Properties and Century Casinos for $385m as well as the Isle of Capri Casino Kansas City in Kansas City, Missouri and the Lady Luck Casino Vicksburg in Vicksburg, Mississippi for $230m to Twin River Worldwide Holdings.

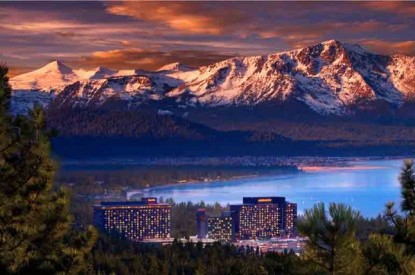

Eldorado CEO Thomas Reeg advised that casinos in Louisiana, where Eldorado operates Eldorado Shreveport and Caesars owns Horseshoe Bossier City; and Lake Tahoe, Nevada, where Eldorado runs Mount Bleu and Caesars has Harrah’s Lake Tahoe and Harvey’s, could also be sold off.

“We’re working through the process,” he said. “We’ve talked to you about markets where you should expect us to be active, in Northwest Louisiana and in the Tahoe area. Beyond that, we’re not expecting any divestitures preclosing that are related to closing the transaction.”

Caption: Harrah’s Lake Tahoe could be sold off by Caesars