Operator News

Personal best in Singapore helps lift Sands China by 42 per cent year-on-year

By Phil - 18 April 2024

Record results in Singapore helped Las Vegas Sands generate revenue of $2.96bn in the first quarter of 2024, up 42 per cent from the $2.12bn in the prior year quarter. Operating income was $717m, compared to $378m in the prior year quarter. Net income in the first quarter of 2024 was $583m, compared to $145 million in the first quarter of 2023.

“We were pleased with our financial and operating results for the quarter, which reflect strong growth in both Macau and Singapore. We remain deeply enthusiastic about our opportunities to deliver industry-leading growth in both markets in the years ahead, as we execute our substantial capital investment programs in both Macao and Singapore,” said Robert G. Goldstein, chairman and chief executive officer.

“In Macau, the ongoing recovery continued during the quarter. Our decades-long commitment to making investments that enhance the business and leisure tourism appeal of Macao and support its development as a world center of business and leisure tourism positions us well as the recovery in travel and tourism spending progresses.”

Since the reopening in early 2023, the annual run rate of the market has grown every quarter from $17bn in Q1 of last year to $22bn, then $24bn and $26bn, now reaching $28bn in annualized gaming revenue.

Mr Goldstein added: “We remain confident, fully confident, in the future growth of the Macau market. I’ve said in the past, Macau market will grow to $30bn and then $35bn and then $40bn beyond in the years ahead, I remain steadfast in our belief.”

Patrick Dumont, President and Chief Operating Officer, added: “The ongoing capital investment programs at The Londoner and at the Cotai Arena had an impact on our results this quarter. The Cotai Arena was closed for renovation in January this year. After the significant reinvestment and renovation, the arena is expected to reopen in November.

“In terms of the second phase of the Londoner, we have now commenced the room renovation on the first Sheraton. We plan the completion of the first tower by year-end and of the second tower by Golden Week in May of 2025. The renovation of the casino on the Sheraton side of London will commence in May of this year with the reopening scheduled for December of 2024.”

“While there will be ongoing disruption from these capital projects, as these products come online between the end of ’24 and the first half of ’25, our competitive position will be stronger than ever. The scale, quality and diversity of product will be better than we have ever offered before. They will be unmatched in the market.”

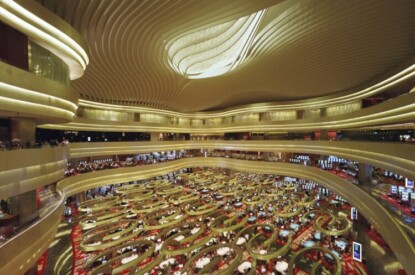

In Singapore, Marina Bay Sands once again delivered record levels of financial and operating performance.

Mr Goldstein said: “We believe it’s a record for the industry. Our new suite product and elevated service offerings position us for additional growth as airlift capacity continues to improve and travel and tourism spending in Asia continues to advance. The team there has done an extraordinary job, and this is what happens when a superior product is located in the proper market. Our financial results in Singapore reflect the impact of our capital investment programs and our service capabilities. The appeal of Singapore as its tourist and destination and the robust entertainment and lifestyle event calendar also contributed to the growth at MBS. As we complete the balance of our investment programs, there will be a lot more runway for growth in the future.

“Our financial strength and industry-leading cash flow support our ongoing investment and capital expenditure programs in both Macau and Singapore, our pursuit of growth opportunities in new markets, and our program to return excess capital to stockholders.

“We repurchased $450m LVS shares under our share repurchase program during the quarter. We look forward to utilizing our share repurchase program to continue to return excess capital to stockholders in the future.”