Pulse

Hungary – for a piece of the pie – Yield Sec

By Lewis - 12 February 2024

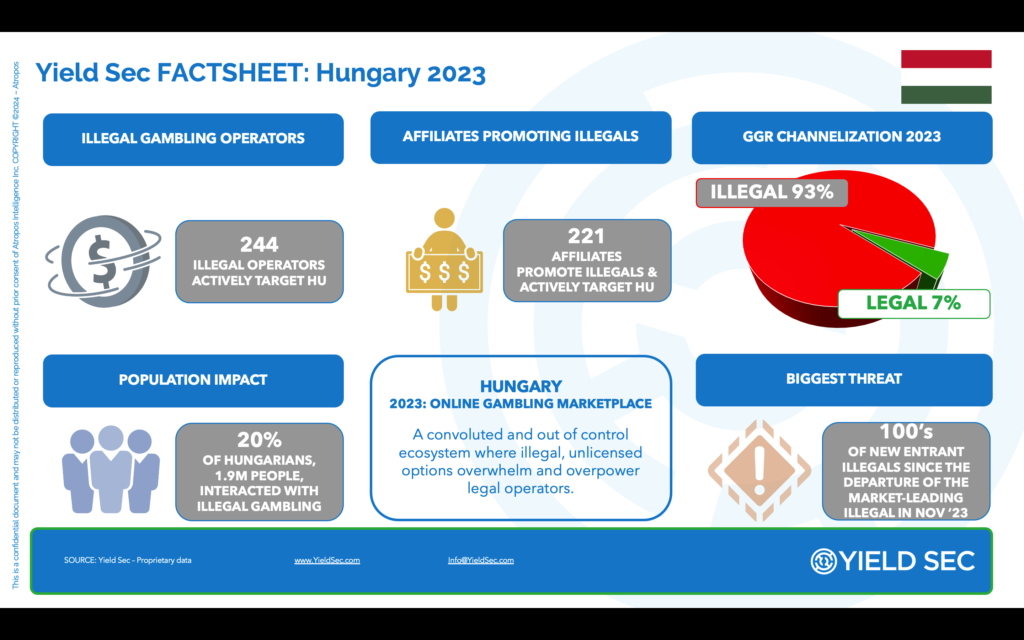

In an exclusive G3 article, Yield Sec’s Ismail Vali reveals the extent of illegal/unlicenced gambling in one of Europe’s fledgling regulated online gambling markets. In the two years since unveiling its new Gaming Act, Hungary has been overwhelmed by illegal operators with channelisation of just seven per cent – and that’s just the start of the problems…

In 2022, Yield Sec’s Ismail Vali presented the gaming industry with the analogy of an online gaming marketplace as an iceberg – the visible snowy cap representing the white market we’ve been led to believe is the entirety of the online gambling market, plus the enormous grey/black mass beneath the waterline that’s the illegal/unlicensed market activity dwarfing everything else.

It’s a picture that’s repeated across Europe, but it doesn’t represent all countries equally. Channelisation is different from country to country, with the highest bar currently set by the UK (Legal GGR channelisation of 96 per cent – Yield Sec 2023). However, what’s been illuminating as we’ve explored exclusive data provided by Yield Sec, is that markets with incredibly low rates of legal channelisation face clear problems, but the potential consequences and solutions are anything but clear cut.

Illegals Overwhelm & Overpower

Yield Sec describes Hungary’s online gambling marketplace as a convoluted and out of control ecosystem where illegal, unlicensed options overwhelm and overpower legal operators. In 2023, the illegal market outweighed the legal market 93 per cent to seven. There are three legal, licensed operators in the restrictive market, which is served by 244 illegal operators actively targeting Hungarian players, with 221 affiliates only promoting unlicensed operators.

Hungary is a recently regulated (2022) ‘white’ market that has tied its online betting and gaming licences to three pre-existing land-based operators: Tippmix Pro, Vegas.hu and GrandCasino.hu. Over the course of two years, however, illegals in Hungary control 93 per cent of the online marketplace – that’s more than three times the global average for illegal online gambling share in any marketplace. For perspective, Hungary channels gambling activity to licensed sites and apps almost 90 per cent less effectively than the UK, the world’s most legally regulated marketplace.

In 2023, licensed operations accounted for just seven per cent of the revenue generated by online gambling activities in Hungary. The vast majority of unlicensed activity was initially generated by grey market ‘legacy’ operators. The lack of legislation governing the online market in Hungary until the recent Gaming Act (Feb 2022), created a vacuum that was filled by major European gaming brands.

Chief among the brands operating in Hungary before the new Gaming Act were Bet365, Unibet and GameTwist. Each of these brands continued to operate in Hungary beyond the introduction of the new Gaming Act and as of the first half of 2023, Bet365 took a 63 per cent share of the market, followed by Unibet at 18 per cent and GameTwist with five per cent. Hundreds of unlicenced operators formed an additional seven per cent, with the three licensed operators splitting the final seven per cent.

Withdrawal Symptoms

Two factors changed in the summer of 2023. The online gambling licensing system in Hungary (introduced January 1, 2023) entered into force on July 1. By August, the Supervisory Authority for Regulatory Affairs (SARA) stated that it was now able to issue a series of fines (up to €250,000), commence IP blocking, and issue criminal reports to the police for illegal gambling against operators and possibly against banks (domestic and foreign) that failed to comply with the strict payment blocking expectations. The second factor saw Yield Sec delivering its report on the size and scale of illegal activity in the gaming market to Hungarian clients.

The week commencing November 28, 2023, long-term unlicensed legacy operator in Hungary, Bet365, pulled out of the marketplace. Bet365 had been the number one sportsbook and casino operator in Hungary since the beginning of Yield Sec’s monitoring. Ads and affiliate links are still present in many places, but directed to a “sorry, you have been blocked’ page. Bet365 had controlled almost two-thirds of the GGR revenue channelisation in Hungary. They remain the number one searched for term across the vast majority of audience keywords and phrases on Google in Hungary. But now they’re gone – and the fallout has been dramatic.

The first revelation is that the three licensed operators, each land-based with tied online gambling licences, have not gained any additional market share. The removal of the dominant 63 per cent market shareholder, Bet 365, has not benefited any of the licensed operators in Hungary, whatsoever. The chaos caused by the departure of Bet365 saw the creation of new and more aggressive affiliate offers from an increasing number of offshore, unlicensed entrants. Bet365’s withdrawal drew more illegal operators to Hungary as a land-grab peaked in the market to replace Bet365 links with other illegals. The market also saw an increase in the size and scale of affiliate bonus offers for unlicensed brands, with affiliates driving the marketplace and few, if any legals, even so much as included on popular affiliate sites.

Bonus offers in the market have spiralled in Hungary, with licensed sites unable to compete with offers from unlicensed operators that are, on average, at least 2.5x more aggressive than the leading local casino brand, Vegas.hu. According to Yield Sec, bonus offers in addition to smart keyword-focused domains that target events and products, as opposed to marketing solely casino/betting brand names, ensure that unlicensed operators retain the upper hand in the market. Licensed operators are largely invisible to the vast majority of the HU audience who find their bets, and the links to them, via HU affiliates, and have done for years – the legacy effect in action. In Hungary, a shocking 85 per cent of all affiliates only promote illegal brands, with a further five per cent promoting both legal and illegal brands side by side. It’s disturbing to find that six per cent of affiliates promote other affiliates – to further compound their relevance and authority across search and social – but only four per cent of all affiliates promote only legal brands. The problem is, hardly any Hungarian consumers visit or convert via those legal-promotion only destinations.

What Hungary has shown is that moving the marketplace needle from unlicensed to licensed regulated gambling is not as simple as just targeting against one or two illegal operators for enforcement. Every action against large illegals splinters the marketplace in favour of even more illegal entrants. Entain’s recent announcement of mass market withdrawal in jurisdictions where they are unlicensed is likely to create exactly the same negative vacuum effect, but on an international level.

Was Hungary destined to fail?

Any system introduced by governments with best intentions, but without proper monitoring, policing and enforcement (MPE) is, according to Yield Sec’s Ismail Vali, doomed to fail. “A system imposing tied-licences, strict pricing policies and limited offers with the aim of raising money from taxation to pay for social welfare and healthcare systems, is very laudable, but without monitoring, policing and enforcement (MPE) – it’s simply not going to work, in practice,” states Vali. “Going from brick and mortar to online doesn’t mean that MPE is impossible, it’s just harder, which is why we created the Yield Sec platform in the first place: to see, know, value and action across the total marketplace, from an audience and activity perspective, and not just hope for legal channelisation in the face of falling or impossible legal operator profitability and sustainability.”

Crime has always been interested in the gaming industry, but for the most part its focus has been upon money laundering activities as opposed to actual operations. However, things are changing according to Yield Sec and their surveillance and data shows that the European marketplace is migrating from ‘soft’ to ‘hard’ criminal activity on a rapid timeline.

“My initial view of the market, when we launched Yield Sec, was that our data was revealing the ‘Great Illegal Gambling Robbery,’” explains Vali. “We had a group of soft criminals, motivated by greed and not fearing any legal consequences, that presented a near risk to the gaming industry. These were and are gaming executives who make more of their money from illegal activity than legal gambling, and cloak themselves in definitions of disguise, claiming “grey market operations”, for example. Let’s cut to the facts here: Grey markets don’t exist anymore. We have online gambling regulation and legislation in most jurisdictions on Earth today – there are more regulated marketplaces than not. This has simply become a legal versus illegal issue, or black versus white for those who still prefer a colour chart for their criminality. I started using the analogy of the iceberg simply to demonstrate the precariousness of all online gambling marketplaces today – that bright, white cap of legal gambling is, invariably, afloat in a sea of criminality, in every online jurisdiction.”

The problem with soft criminality/grey market activity is that it creates an unequal marketplace. The legal market operates with restrictions to its offers, advertising, profits and market reach. Not only that, but the combined total marketplace activities of white, grey and black, or legal and illegal, creates the misconception that the licensed industry is solely responsible for all gambling activity in the market, when it’s only answerable for a fraction of market revenue. And so, when market share for licensed gaming falls below 50 per cent, and in markets such as Hungary, below 10 per cent, the legal market is unable to produce sustainable revenues, consequent taxation, responsible gambling funding, let alone produce or maintain anything like projected profitability and, if relevant, publicly-traded market cap – a scenario we’re currently seeing in multiple gambling jurisdictions, not least of which is the United States.

“While the near risk is problematic, the far risk is much, much worse,” warns Vali. “All of the unenforced against illegal gambling activity we have today, and the reluctance to sometimes simply deal with illegal gambling since some feel it has been misused as “a distraction” to avoid further regulation by legal industry lobbying groups and trade bodies, is inviting a terrible destiny: a future where organised crime and transnational criminal gangs are interested in online gambling not just for the money laundering conduit, but for overall control of the gambling ecosystem and audience, period. This is not some far-off fable I am suggesting – this is happening right now, and one only needs to detail a few legal, regulatory and marketplace failures, now visible on every continent, to see that the far risk has clearly and presently arrived: activity by Sicilian N’drangheta Mafia in Malta, Triads in the Philippines and Thailand, Narco Cartels in Mexico and northern LATAM, are but a few examples of recent crossovers from near to far risk in our online gambling marketplaces.

In Vali’s opinion, a marketplace like Hungary has two options:

Option 1: Channelise the legal brands.

Ruthlessly efficient monitoring, policing and enforcement must be implemented to have any sense of a contained, controlled and regulated marketplace. This option has to be implemented prior to, and throughout, any consideration of Option 2.

Option 2: Liberalise the marketplace.

Allow more licencees in, potentially embracing amnesty conditions for previously illegal operators

Given the traffic and revenue dominance of illegal brands, inviting them in for licensing with amnesty and/or local brand partnership conditions must be considered. Marketplace access deals can fail, as we’ve seen with Tribal Gaming operators in the US, but that’s because the black market was not enforced against, first. Should Hungary wish to compromise with current and historic illegal brands, given their marketplace status today, the right climate is achievable. However, no commercially intelligent deal will be possible without some level of activated enforcement against the black market, first. Only when things are difficult for illegal entrants, will they truly feel like valuing local partners, and the government, commercially and practically.

Lobbying the government for umbrella licensing is also not without its risks. Even with the right commercial climate for partner deals, the public, politicians and government will require convincing to allow what are, effectively and literally, thieves today to enter the marketplace, via payment and revenue sharing to a local partner for that umbrella license privilege. Legal change and deal negotiation would be needed, during which some illegals could continue to earn money and market share whilst wasting time. A trend that “made hay while the sun shone” for many brands in Germany and the Netherlands, as they played footsie with their potential legalisation, only to never actually submit licensing paperwork, in the end.

Grey market and soft criminals

Searches for ‘Bet365’ in Switzerland are the most popular gambling term in that country. More than ‘casino,’ more than ‘soccer betting’ or even ‘Messi’ during the World Cup. ‘Bet365’ is the most searched for betting term in Switzerland and number two is ‘Bet 365’ with the space between the words included.

“The audience is saying they want Bet365. If the brand is that popular, surely a more optimal outcome is to acknowledge that market presence,” says Vali. “We need to find pragmatic ways to recognise the most popular brands in the market. Acknowledge that they have licences in other markets – and pose the question: why don’t we discuss legal operations in our market? Agree a deal to provide ‘$X’ amount in taxes for the first five years, for example, and compel them to work with the existing licensed brands in the local market or simply be incentivised to acquire those local brands through M&A. Hardly a revolutionary or surprising suggestion given that local expertise consolidation is a cornerstone of the global iGaming business dynamics.”

If you want control of the entire market, there are options on the table. The pragmatic model recognises there is a ‘hard criminal’ element that you do not want in your market, and, at the same time there’s a soft criminality that you may, likely will, need to work with – as they’re much more malleable than the hard variety. Vali describes them as: “gangsters without guns.” They would potentially pay years of back taxes to have a clean legal status – which is exactly what the PokerStars precedent in the USA established.

“The vast majority of the legacy brands did not set up in business to be criminals – that’s not what they are in their nature – but they’re branded this way because they’re taking illegal revenue,” states Vali. “Given the threat of a soft/hard criminality crossover, we simply have to find practical ways out of a scenario that is inviting too much attention and interest from what we used to consider the “far risk” – from organised crime entering iGaming not simply for money laundering opportunities, but for operational control.

“If you create the right monitor, police and enforce environment, using a platform like Yield Sec to help achieve channelisation critical mass, governments and regulators can invite legacy black market brands back into the licensed spectrum and unlock the payment of back taxes, fines and “special conditions” to bring the marketplace to a position of positive channelisation, where online gambling activity can truly benefit local commerce and community. Bet365’s U-turn in Hungary sets a precedent: They’re demonstrating risk aversion in Hungary, and I think there’s a conversation to be had because of this. Ignoring it is, I think, an opportunity that could be missed. That decision to leave Hungary is seismic: Bet365 is a brand that has rarely left a marketplace, but now, all of a sudden, they voluntarily step out of Hungary. Why leave a marketplace in which you’re so dominant and in which the consumers are actively looking for you, as Yield Sec audience monitoring demonstrates?”

Back to the start

If you want control of a marketplace, legal gambling must replace and prevent illegal gambling. Talk about protecting citizens is a corollary to the actual issue. Get rid of crime and you get rid of the consequences of crime. Regulators and governments need a toolkit that includes talking to and rehabilitating unlicensed brands. There needs to be a reckoning against those brands for previous sins, but as part of this process the ‘soft criminals’ need to be in the room, a part of the conversation and ultimately, part of the solution.

The German, Swiss, and Hungarian consumer all see unlicensed brands as the ‘leading trusted brands’ in each of their respective markets. Part of the reason for this has been legislative prevarication when implementing laws over a period of the past 20 years. After which, regulators say things like: the majority of the market is channelised based upon taxation return numbers. However, that’s from winning customers who declared that income upon their tax returns – which is a tiny sum compared to the black market figures for turnover.

Governments need to engage with unlicensed brands and they need to engage in dialogue. Of course, this will shock and annoy the licensed local brands in the market, whose view is rightly that illegals should be shut out completely from the market. However, no one is benefitting from this approach. In the US, if an understanding could be brokered that allowed unlicensed brands to partner with US Tribes, for example, the Tribes’ yearly sports betting rights wouldn’t be worth the tiny sums they are today, but up in the millions of dollars for access rights and revenue shares, per year, that States and Tribes had originally predicted.

In Switzerland, unlicenced brands could pay the 10 casinos with online licences to be their official betting partner. Casinos could offer sports betting via Bet365 or Unibet, who’d pay each of the casinos for the rights. The marketplace becomes competitive, channelised and actually makes money for the operators and generates taxes for the government and community. The counterargument from the casinos is that sports betting would cannibalise income from their casino customers, but Yield Sec’s data shows that it’s already happening – only without any benefit accruing to the casinos.

Can prohibition work?

The local brands in Hungary want to fix the issue themselves. They understandably have no compassion for a methodology that ‘invites their enemies to the table.’ At the same time, the government is seeking to crack down on enforcement, issuing the SARA notice in August 2023, warning that payment blocking fines will be imposed repeatedly for offenders.

Unfortunately, it’s mostly posturing. A familiar pattern plays out when government agencies crack down on payment enforcement, which is predominantly through VISA or MasterCard in a market like Hungary. As soon as you attack that source it immediately switches to aggregators, which effectively removes each payment method from the radar. Government and financial agencies are no longer able to track payments, especially illegal gambling payments conducted through PayPal and other online wallets, which illegals have switched to miscoding transactions with for things as innocuous as “online clothing” or “food delivery” sales. Crackdowns simply lead to the aggregators, and payment service providers behind online wallets, very effectively hiding the transactions, and these payment masking methods are seen by Yield Sec to change frequently, sometimes as much as hourly across marquee events like World Cup and Premier League football matches, to protect revenue to illicit operators.

“Whatever a government wants for their online gambling marketplace, they can have with a Yield Sec-supported view of monitoring, policing and enforcement (MPE). Any government coming to us, desiring a 100% prohibition model for example, our answer is yes, you can absolutely achieve that, so long as you commit to a 24/7, 365 days a year MPE framework,” states Vali. “Knowing that crime is there is one thing. Doing something about it, however, is fundamental. Yield Sec exists to help and support legal stakeholders to move the needle against crime and towards a positive, channelised marketplace.

“There’s little point knowing about crime without enforcing against it. The smallest gap in monitoring or delay in enforcement creates opportunity for crime, and weak enforcement without a constant cadence allows crime to adapt, reform and refill the marketplace, only it moves a little bit further away from where today’s political attention was. This marketplace infiltration and theft, as well as the consumer harm and misery it creates, should no longer be about politics: it’s a law enforcement and criminal justice matter because every marketplace is being stolen from. Every day.

“Across every form of online gaming. One unlicensed operator leaving the market in Hungary has made the illegal situation far worse, and not one legal operator has benefited – which means taxation receipts have not increased and funding for responsible gaming and the protection of the vulnerable will remain carried by the legal, licensed entities alone. This is simply unsustainable – what happens when a marketplace is so dominated by crime that you can no longer pay for responsible gaming, period?

“We know there are mega-brands operating without licences throughout Europe: so, start thinking about repatriating them and bringing them onshore, with sliding scale license conditions that allow local brands to compete effectively; taking windfall payments for back taxes, fines and consumer harm settlement; establishing partnership dialogue for “immigrant” brands with local “patriots”; actively avoid the far risk of organised crime infiltration and control; and, moving the needle across your marketplace dynamics so that legal gambling achieves its purpose: replacing and removing illegal gambling.”

Amnesty national

Most European marketplaces are headed towards a 50/50 split between legal and unlicensed/illegal gambling. Yield Sec’s data shows this is trending towards being normal. Whatever social policies have been enforced in the past, from a brick and mortar perspective, trying to export those same models to online has either failed, or is failing. Regulators can’t ignore the preferences of online audience behaviour. “We need to reset the paradigm based on audience and product activity data,” underlines Vali. “Either take the route of excessive enforcement, or let some of the soft criminals, the unlicensed operators come to the table, which increases the pie for everyone. Having a larger legal onshore industry creates a better environment all round: more of that bright white cap of the iceberg above the waterline, visible to all and casting light into the darkness around it, giving crime less opportunity to hide and create harm.”

Bet365 represented two-thirds of the Hungarian market with legals failing to occupy 10 per cent of the space. Vali argues for allowing Bet365 to work with the licensed operators, to make them street legal. “There are the brands that are just under the waterline,” he says. “What you don’t want is for the legacy brands in Hungary like Bet365 to leave, creating a vacuum that’s been filled with market infiltrators, who are basically trying to make out they’re a part of the gaming industry, when in fact they’re simply criminals.

“When we launched Yield Sec it was the year of the World Cup, and we were able to look at the volume of illegal gambling during that period, which was immense. This year there is no pause in the football calendar. The 2023/24 football season ends, the European Championships start, then it’s the Olympics and the 2024/25 season kicks off. There is no natural pause in punting across in 2024, and this can lead to unbelievable gambling harm and addiction problems wrought by the illegals if we don’t start to practically get to grips with the dark side, now.”